2.1 interest rates banking institutions 2018

The sanctions can be either comprehensive or selective using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals. This includes regional national and global economies.

The Determinants Of Conventional Banks Profitability In Developing And Underdeveloped Oic Countries

The economic growth rate is calculated from data on GDP estimated by countries statistical agenciesThe rate of growth of GDP per capita is calculated from data on GDP and people for the initial and final periods included in the analysis of the analyst.

:format(webp)/https://www.thestar.com/content/dam/thestar/life/advice/2018/07/31/mortgage-brokers-vs-banks-the-pros-and-cons/_1_main_mortgage_and_key.jpg)

. On March 18 1970 postal workers in New York Cityupset over low wages and poor working conditions and emboldened by the Civil Rights Movementorganized a strike against the United States government. The Panic of 1907 convinced many Americans who of the need to establish a central banking system which the country had lacked since. Originally developed as instruments for the corporate debt markets after 2002 CDOs became vehicles for refinancing mortgage-backed securities MBS.

Basel III is the third Basel Accord a framework that sets international standards for bank capital adequacy stress testing and liquidity requirementsAugmenting and superseding parts of the Basel II standards it was developed in response to the deficiencies in financial regulation revealed by the financial crisis of 200708It is intended to strengthen bank capital. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Like other private label securities backed by assets a CDO can be thought of as a promise to pay investors in a prescribed. The National Credit Union Administration reports that as of December 2018 the five-year loans for new cars at banks had an average interest rate of 504 percent compared with 357 percent for. The strike initially involved postal workers in only New York City but it eventually gained support of over 210000 US.

More information about these data is available in table 2. A collateralized debt obligation CDO is a type of structured asset-backed security ABS. Insurance is a means of protection from financial loss in which in exchange for a fee a party agrees to guarantee another party compensation in the event of a certain loss damage or injury.

The three richest people in the world possess more financial assets than the lowest 48 nations combined. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. Islamic banking Islamic finance Arabic.

Ihre übergeordneten Ziele bestehen in der Wahrung der Finanzstabilität in der EU und dem Schutz der Integrität der Effizienz und des. Oil and petroleum products account for. Sometimes Keynesianism named after British economist John Maynard Keynes are the various macroeconomic theories and models of how aggregate demand total spending in the economy strongly influences economic output and inflation.

Mortgage loan basics Basic concepts and legal regulation. Post Office Department workers across the. Private equity PE typically refers to investment funds generally organized as limited partnerships that buy and restructure companiesMore formally private equity is a type of equity and one of the asset classes consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.

The banking authorities whether central or not monetize the deficit printing money to pay for the governments efforts to survive. The tax rates rules and. A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments.

In the Keynesian view aggregate demand does not necessarily equal the productive. MicroeconomicsDistributionPersonal Income Wealth and Their Distributions G01. And 1698488 in 2018.

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23 1913. Living standards vary widely from country to country and furthermore the change in living standards over time. A given economy is a set of processes that involves its culture values education.

The combined wealth of the 10 million dollar millionaires grew to nearly 41 trillion. Large Financial Institutions. A private-equity investment will generally be.

For example using interest rates taxes and government spending to regulate an economys growth and stability. An economy is an area of the production distribution and trade as well as consumption of goods and servicesIn general it is defined as a social domain that emphasize the practices discourses and material expressions associated with the production use and management of scarce resources. Keynesian economics ˈ k eɪ n z i ə n KAYN-zee-ən.

The remaining 51 percent were held by non-Government financial institutions HDFC. A study by the World Institute for Development Economics Research at United Nations University reported that the richest 1 of adults alone owned 40 of global assets in the year 2000. Macroeconomics and Monetary EconomicsMonetary Policy Central Banking and the Supply of Money and CreditMonetary Policy D22.

مصرفية إسلامية or Sharia-compliant finance is banking or financing activity that complies with Sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture. Finance also known as financial economics is the study and discipline of money currency and capital assetsIt is related with but not synonymous with economics the study of production distribution and consumption of money assets goods and servicesFinance activities take place in financial systems at various scopes thus the field can be roughly divided into personal. OFAC administers a number of different sanctions programs.

MicroeconomicsProduction and OrganizationsFirm Behavior. In the first resort the risk is that of the lender and includes lost principal and interest disruption to cash flows and increased collection costsThe loss may be complete or partial. In an efficient market higher levels of credit risk will be associated with higher borrowing costs.

The history of banking began with the first prototype banks that is the merchants of the world who gave grain loans to farmers and traders who carried goods between cities. The confidence interval is derived from forecasts of the average level of short-term interest rates in the fourth quarter of the year indicated. A financial market is a market in which people trade financial securities and derivatives at low transaction costsSome of the securities include stocks and bonds raw materials and precious metals which are known in the financial markets as commodities.

The term market is sometimes used for what are more strictly exchanges organizations that facilitate the trade in. The latest being on 22 December 2018 where a panel of federal and state finance ministers decided to revise GST rates on 28 goods and 53 services. Sanctions in 2018 has once again cut deeply into a vital source of national revenue.

An entity which provides insurance is known as an insurer insurance company. Die Europäische Bankenaufsichtsbehörde EBA ist eine unabhängige EU-Behörde deren Aufgabe es ist ein wirksames und kohärentes Maß an Regulierung und Beaufsichtigung im europäischen Bankensektor zu gewährleisten. The law created the Federal Reserve System the central banking system of the United States.

Where is OFACs country list. The end of sanctions waivers on oil exports and the restoration of US. In the 1970s in the United Kingdom inflation reached 25 per annum yet interest rates did not rise above 15and then only brieflyand many fixed interest rate loans existed.

This was around 2000 BCE in Assyria India and SumeriaLater in ancient Greece and during the Roman Empire lenders based in temples gave loans while accepting deposits and performing the change of. Macroeconomics from the Greek prefix makro-meaning large economics is a branch of economics dealing with performance structure behavior and decision-making of an economy as a whole.

The Pros And Cons Of A Credit Union Versus A Bank

Small Business Commercial Industrial Loan Balances Increase Year Over Year Federal Reserve Bank Of Kansas City

Scaling Up Multilateral Bank Finance For The Covid 19 Recovery Odi Think Change

Pdf Financial Markets And Institutions 9th Edition Mishkin Test Bank Mohammed Rajab Academia Edu

European Central Bank Wikipedia

Visualizing The 200 Year History Of U S Interest Rates

Chart Global Banks Hike Up Interest Rates Statista

Financial Stability Review May 2021

Walk Don T Run Mid Year Update 2022 Kkr

The Fed S Plan To Shrink Its Balance Sheet Quickly

Federal Net Interest Costs A Primer Congressional Budget Office

Integration In Banking Efficiency A Comparative Analysis Of The European Union The Eurozone And The United States Banks Emerald Insight

Best Savings Accounts For October 2022 Bankrate

Negative Interest Rates Excess Liquidity And Retail Deposits Banks Reaction To Unconventional Monetary Policy In The Euro Area Sciencedirect

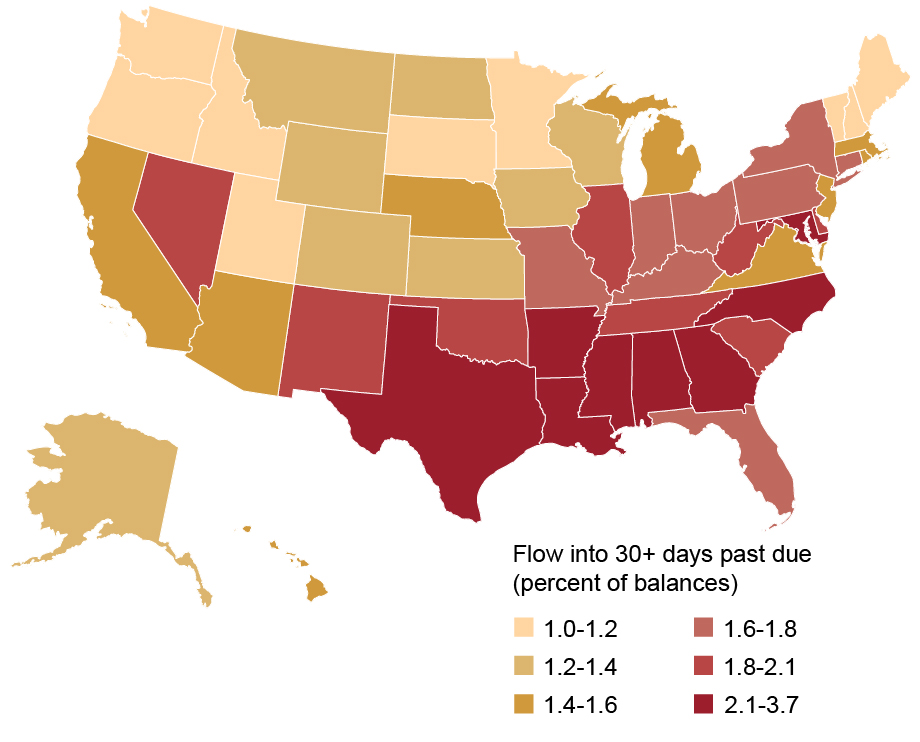

Historically Low Delinquency Rates Coming To An End Liberty Street Economics

Bank Profitability And Risk Taking Under Low Interest Rates Bikker 2018 International Journal Of Finance Economics Wiley Online Library

0 Response to "2.1 interest rates banking institutions 2018"

Post a Comment